For Net New Customer Identification

Identify and prioritize high-potential new customers — in any region or application — by leveraging structured insights from your existing product and customer data.

The Problem

Finding net new customers in the chemical and ingredient industry is slow, manual, and often based on incomplete or unreliable information.

01

Limited Market Visibility: There are few reliable public sources for identifying companies that purchase significant volumes of chemicals, especially in unfamiliar geographies or emerging applications.

02

Underutilized Internal Data: Existing customer and transaction data often sits in silos, messy and unstructured, making it difficult to spot patterns or create accurate ideal customer profiles.

03

Opaque Customer Needs: End-customers often avoid sharing details about what they manufacture, preventing suppliers from knowing which chemicals or ingredients are essential to their production.

04

05

The Solution

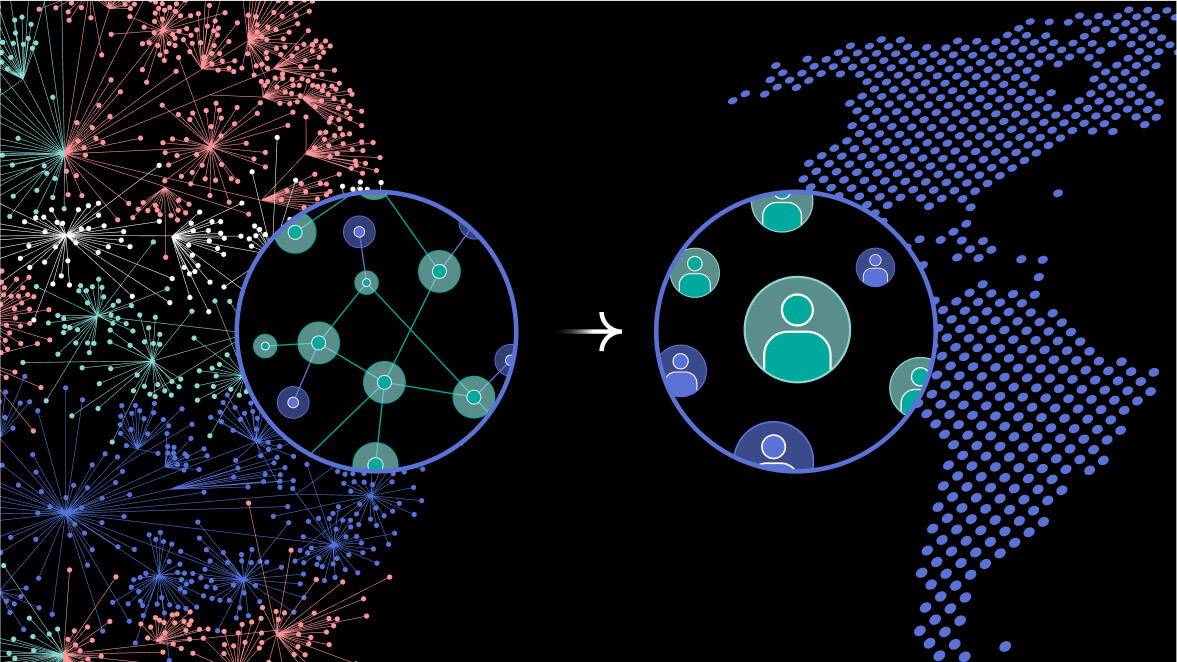

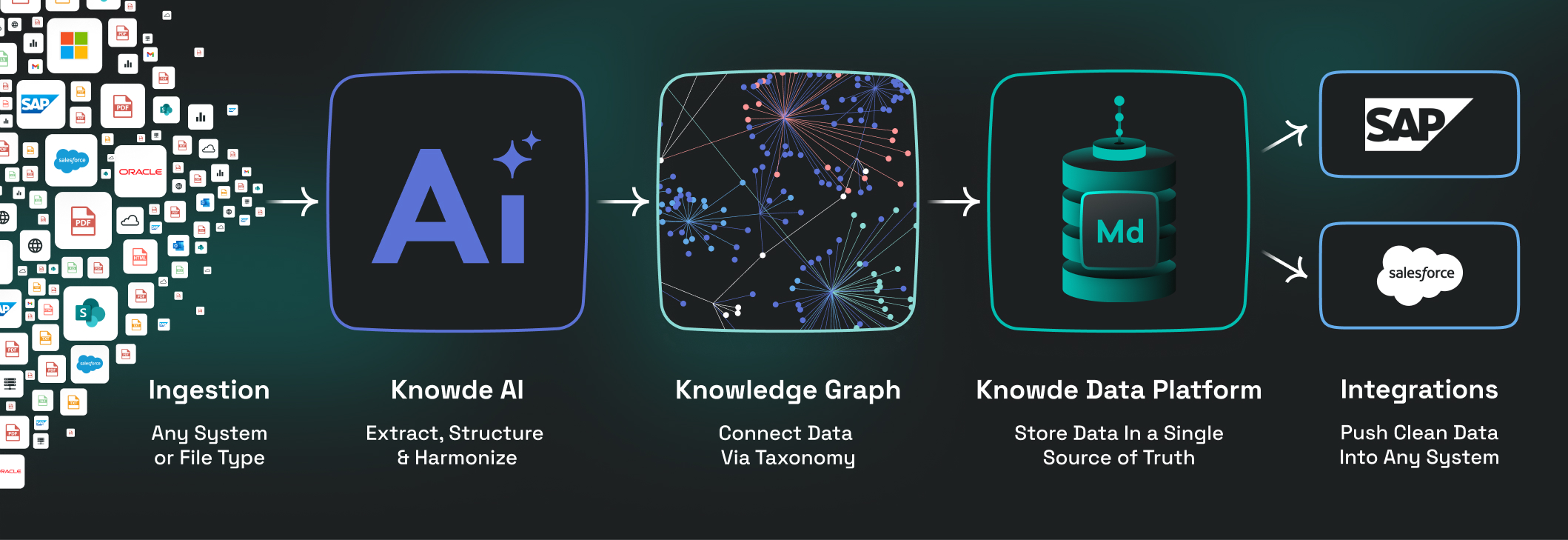

Knowde structures, enriches and connects your customer and product data to surface lookalike prospects and uncover high-fit accounts outside your current pipeline.

01

Clean, Unified Data Foundation: Consolidates and harmonizes product and customer records from ERP, CRM and other systems, removing duplicates and aligning attributes.

02

Manufacturing Intelligence Enrichment: Adds detail on what customers make, their applications and potential raw material needs, mapped to your product portfolio.

03

Lookalike & Pattern-matching Analysis: Identifies new companies with similar profiles to your highest-value customers, enabling targeted prospecting in new markets or applications.

04

05

06

Positive Business Outcomes

Sales teams generate more high-quality opportunities, convert prospects at higher rates and expand into new regions and applications with precision.

01

Faster Pipeline Growth: Quickly identify and qualify accounts not yet in your CRM or sales funnel.

02

Higher Conversion Rates: Focus sales efforts on companies most likely to buy, based on proven product fit.

03

Targeted Market Expansion: Enter new geographies or applications backed by data-driven account prioritization.

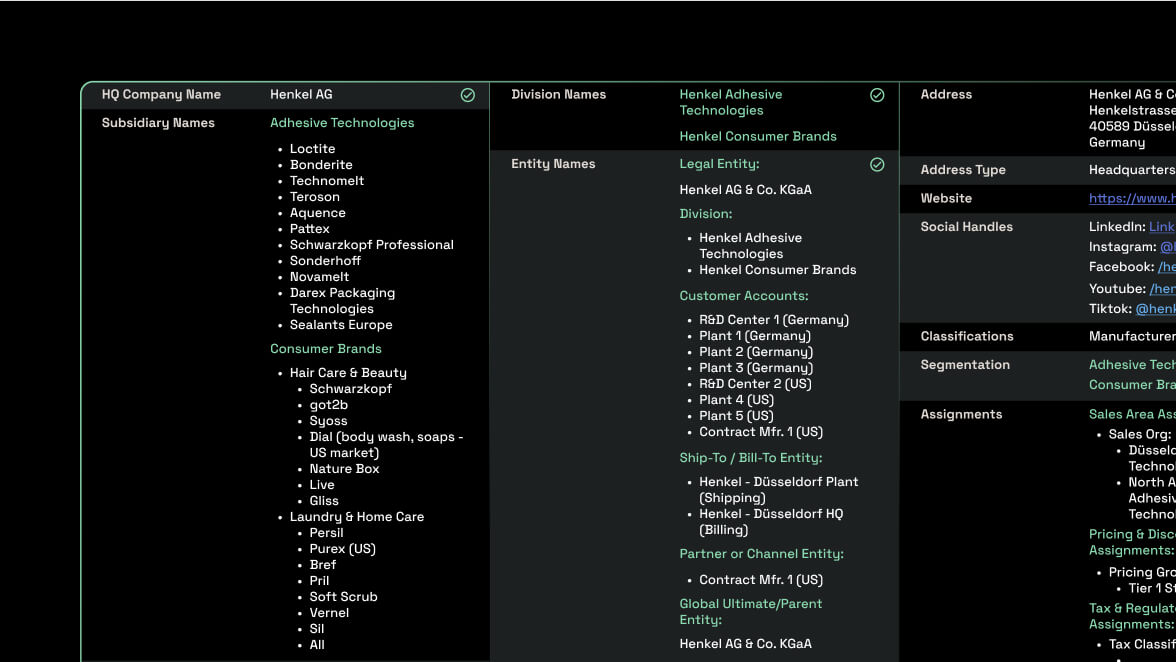

How We Do It

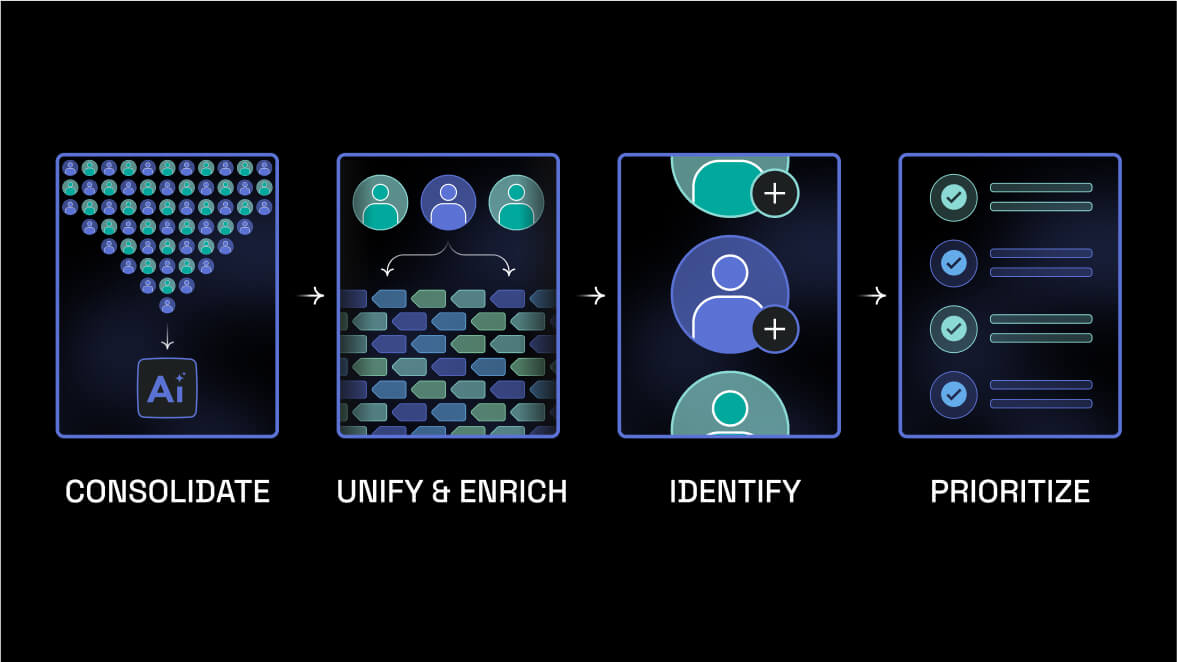

Step 1

Consolidate Product Data: Organize portfolio by chemistry, function, application and technical attributes.

Step 2

Unify Customer Data: Merge and deduplicate accounts, creating golden records with parent-subsidiary-site hierarchies.

Step 3

Enrich With Manufacturing Intelligence: Tag customer records with what they make and link needs to your products.

Step 4

Identify Lookalikes: Use attribute-based matching to find similar companies not yet in your base.

Step 5

Prioritize for Action: Score and segment prospects for targeted outreach, campaigns or channel enablement.

Step 6

Return on Investment

+20–30% increase in qualified opportunities within the first year

50% faster prospect identification compared to manual research

Higher win rates from focusing on best-fit accounts

Accelerated revenue growth without increasing sales headcount proportionally