For Tail Spend Management

Bring control, clarity and savings to the forgotten 20%.

The Problem

Tail spend in chemicals, ingredients and polymers is messy, expensive and largely unmanaged.

01

Thousands of low volume material purchases (typically outside of contracts) from hundreds of vendors fly under the radar. These buys are spread across tens of plants, buyers, and ERP instances, with little visibility or standardization. The result: high prices for low-volume orders, too many suppliers, raw material proliferation and an enormous manual workload for procurement teams.

02

Large raw material portfolios and limited procurement resources result in most optimization efforts being directed at highest spend materials. Tail spend is minimally managed and is often only an area of focus as a reaction to an adverse event such as price increase or supply chain issue.

03

Up to thousands of materials and billions in spend (or approximately 20% of total direct spend) are not actively managed in terms of pricing, security of supply, consolidation, rationalization and most other procurement best practices.

04

Disparate and incomplete raw material data inhibits consolidation of spend, identification of risks, leveraging full purchasing power or utilization of tools like marketplaces, automatic RFPs or e-tenders to accelerate renegotiation.

05

Master data issues compound with multiple ERPs, regions that operate independently, independent business units, M&A activity and inconsistent data stewardship practices.

The Solution

Make it easier for procurement teams to analyze and manage tail spend.

01

Knowde helps your procurement team identify, classify and consolidate fragmented tail spend on direct materials — so you can reduce vendor bloat, manage risk, and reduce costs across plants and regions.

02

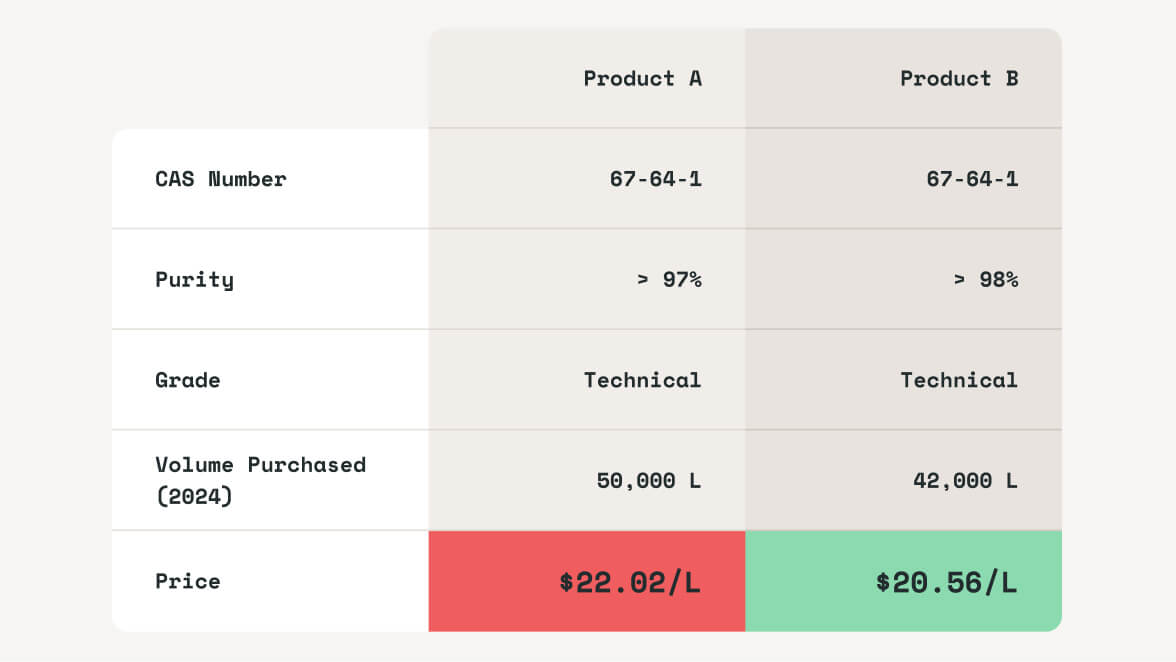

Use clean data to identify opportunities to consolidate spend. Leverage newly found purchasing power to renegotiate pricing. Utilize tools such as automatic RFP generation to maintain competitive pricing.

03

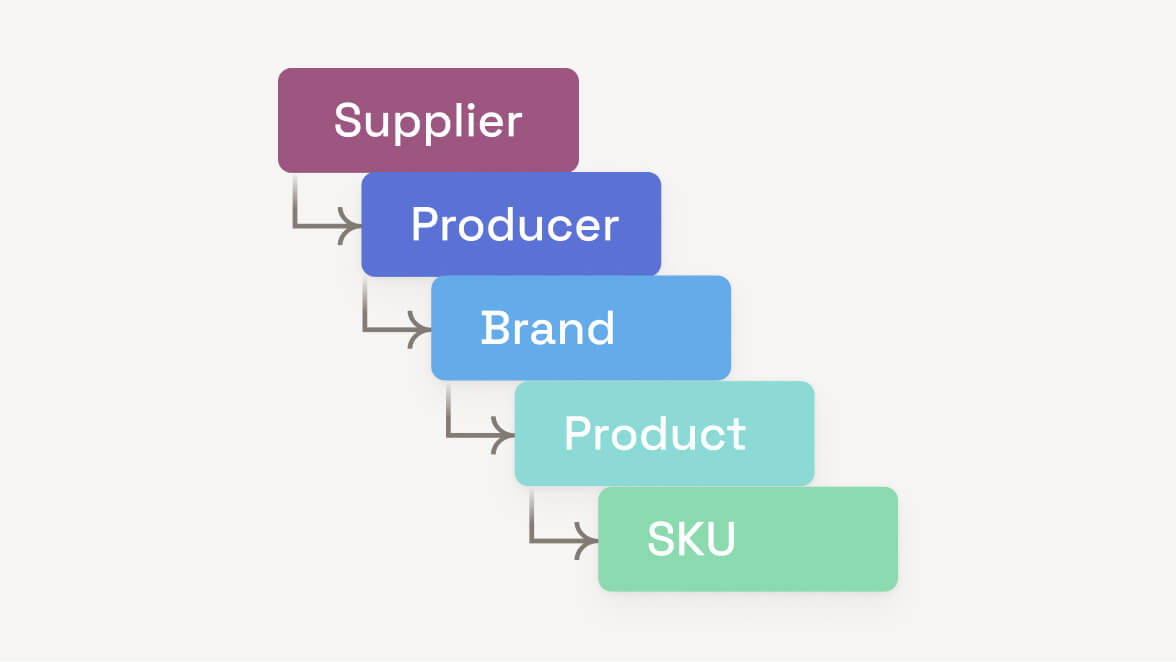

We consolidate your raw material portfolio into a single source of truth, with a clean hierarchy of supplier, manufacturer, brand, product and SKU. We eliminate duplicates and outdated information. Then, we enrich records with technical properties, specifications, certifications and all relevant product information.

04

You can then leverage clean data to identify opportunities to consolidate spend, harness newly found purchasing power to renegotiate pricing and utilize tools such as automatic RFP generation to maintain competitive pricing.

05

06

Positive Business Outcomes

Tail spend is no longer a blind spot. Your procurement team increases their purchasing power while decreasing the risk from single sourced raw materials.

01

Buyers gain the tools to control cost and supplier count in the long tail.

02

They can identify single sourcing risks quickly and act on them proactively.

03

This frees up time and focus for strategic sourcing, while quietly recovering margin from the bottom of the spend curve.

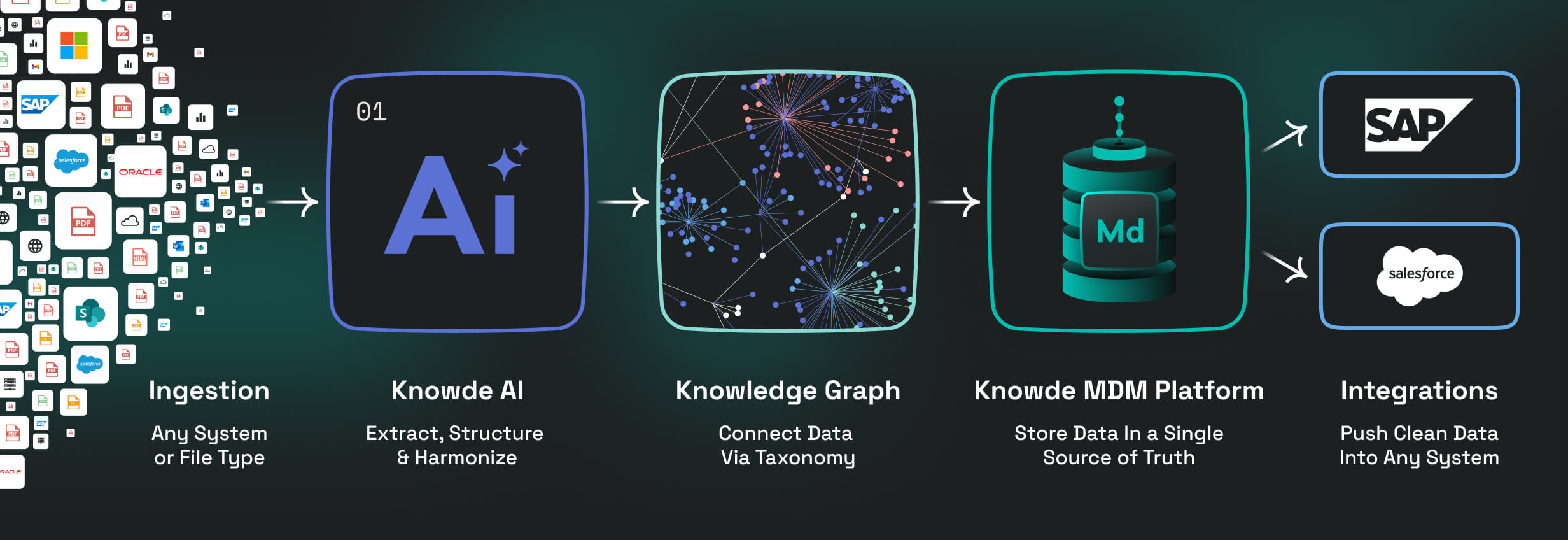

How We Do It

Step 1

Consolidate and Harmonize Vendor Master: Knowde deduplicates and consolidates supplier records across legacy systems. We harmonize vendor attributes across regions, locations and divisions to create a single source of truth.

Step 2

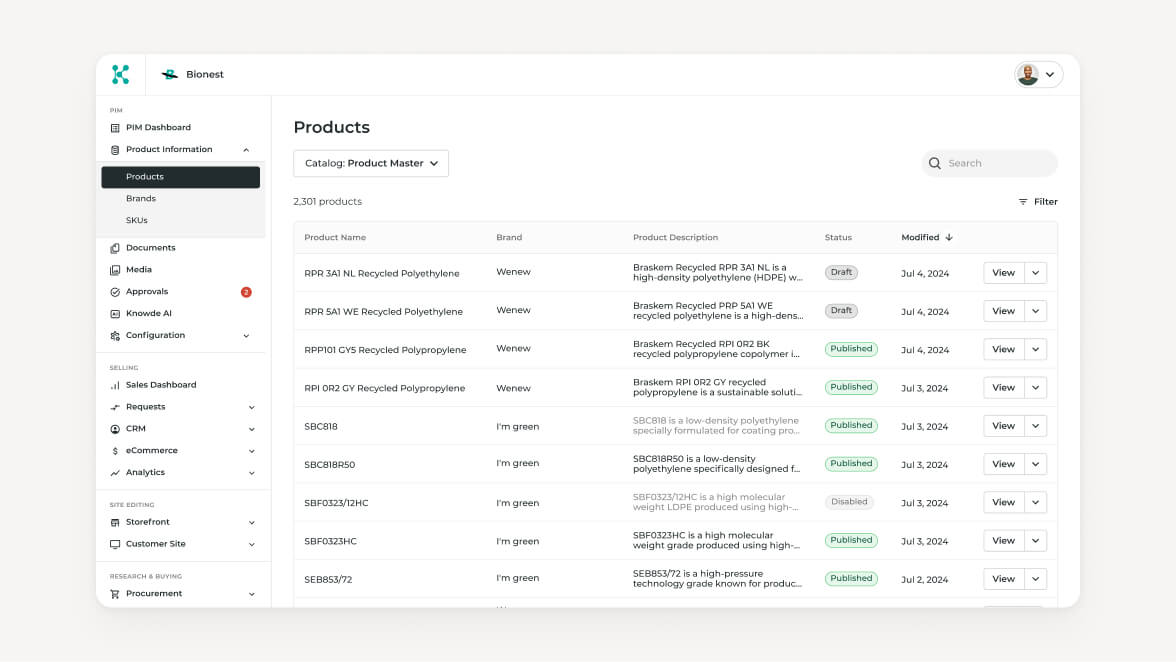

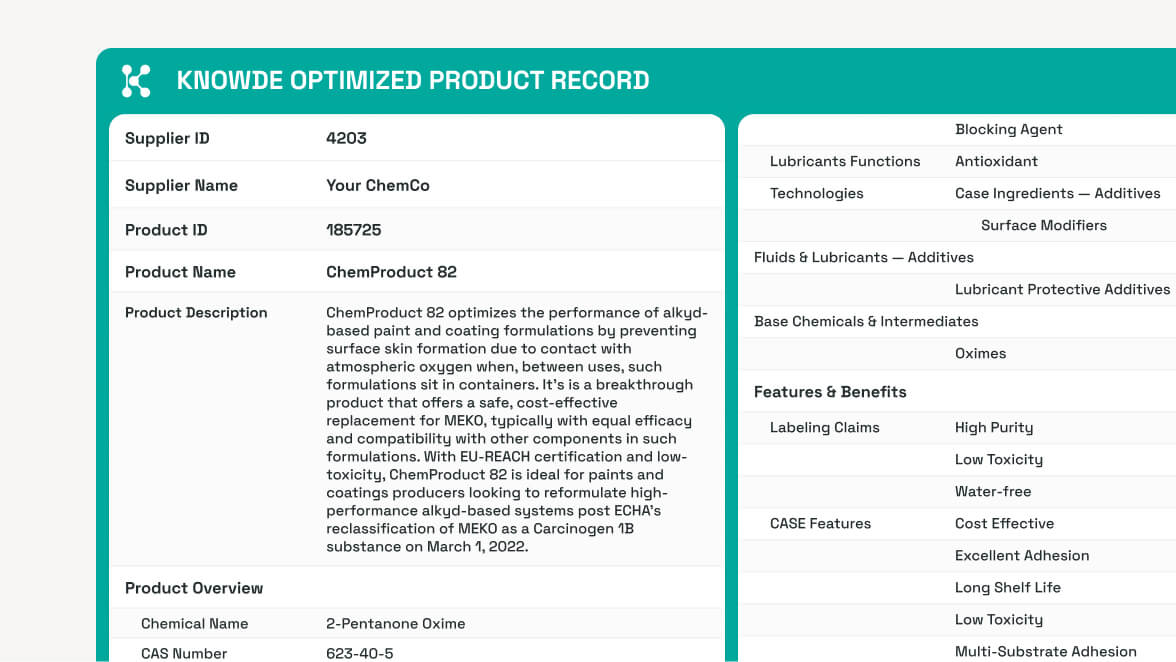

Consolidate and Harmonize Raw Material Master: We consolidate raw material data across multiple systems into a single source of truth. Knowde AI eliminates duplicate entries, standardizes descriptions, technical specifications and classifications to build a unified raw material portfolio across regions, locations and divisions. This enables more granular segmentation of raw material categories and easy identification and comparison of overlaps and equivalent materials.

Step 3

Enrichment of Vendor and Raw Material Records: We enrich vendor records with size, locations, other products available in their portfolio and more. Knowde AI enriches raw material records to include distribution channels and potential equivalent materials purchased across locations globally. This allows for identification of consolidation opportunities and avoids raw material proliferation as new materials are considered for product development.

Step 4

Step 5

Step 6

Return on Investment

80–90% improvement in raw material data quality

1-5% raw material cost reduction on up to 20% of raw material portfolio

20–40% reduction in single-sourced material risk

Minimized risk of plant shut down due to material availability or price volatility